Coding and Billing

Coding and Billing for the National DPP Lifestyle Change Program

The purpose of this page is to provide information about coding and billing to ensure the National Diabetes Prevention Program (National DPP) lifestyle change program is reimbursed appropriately and in a timely manner. Correctly coding and billing for the National DPP lifestyle change program can also help drive quality and process improvements as well as meet compliance requirements in case of an audit. Submitting improper codes or claims to payers may result in non-payment or added time and expense for re-submission of the claim or invoice.

Codes

Coding generally requires two elements:

- Providing a code that shows the payer what services were performed (CPT, HCPCS); and

- Providing a code that shows the payer that the services provided were medically appropriate (ICD-10).

The table below provides an overview of these codes and examples of how they can be applied in the National DPP lifestyle change program.

CPT Codes

About CPT Codes

Current Procedural Terminology (CPT) Codes are a group of procedure codes used in medical billing. These codes were created by the American Medical Association (AMA) in 1996 to standardize reporting of medical, surgical, and diagnostic services and procedures and serve as a common language between providers and payers. Each CPT Code represents a written description of a procedure or service and eliminates the subjective interpretation of what was provided to a patient or client.

In addition to providing billing information to payers, CPT codes can help payers and researchers measure health data, the value of services, quality of care and performance, and how efficiently medical care is delivered.

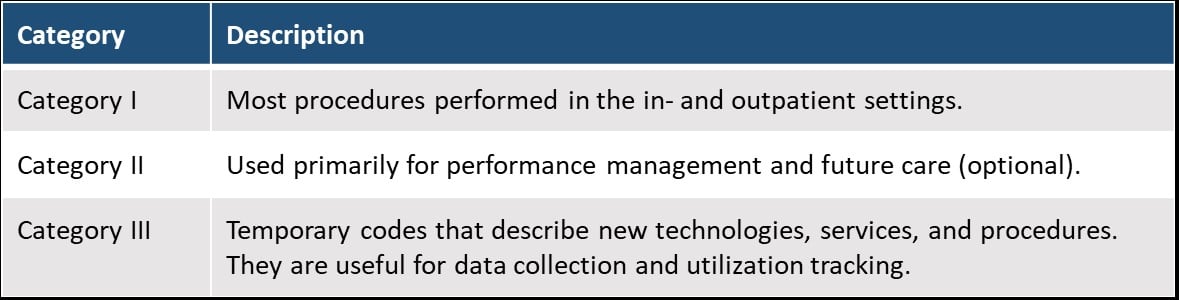

There are three types of CPT Codes, described below. Category I codes are always in numeric format (codes range from 00100-99499) and Category II and III codes are alphanumeric (consisting of numbers and letters).

Applying CPT Codes to the National DPP

CPT Codes 0403T and 0488T

The National DPP-specific CPT codes (0403T and 0488T) are intended to be used by CDC-recognized organizations that provide nonclinical National DPP lifestyle change program services.

Code 0403T signifies programs that are provided in-person and can be billed once per day. Some states, such as Oregon, have used a GT modifier to indicate when the program is offered through distance learning delivery. Code 0488T signifies a program delivered online. The 0488T code is only billable once per 30 days, so typically the payment associated with 0488T would be higher than the payment for 0403T (see the Oregon example below). Neither of these codes should be used for individuals with established diabetes.

CPT modifiers might be used by payers and provider organizations in conjunction with the codes to denote program milestones attached to specific pay-for-performance reimbursement metrics.

There are a few important elements to note about the CPT codes 0403T and 0488T. First, they are category III codes (temporary codes for emerging technology, services, and procedures) that may be converted to a Category I code at a future date. The CPT Editorial Panel sets the criteria for a level conversion which is allowed once the procedure is considered consistent with contemporary medical practice and widely performed. Second, some payers and Medicaid agencies may not be able to reimburse for these codes because of their temporary status. Third, CPT modifiers may vary across provider organizations, payers, and states.

For more information on National DPP-specific CPT codes, see the CPT Code Guidance document created by the American Medical Association (AMA).

To learn more about the CPT coding system please see the CPT Code Brief page.

CPT Codes in Practice: Oregon’s Medicaid Reimbursement Model

Effective January 1, 2019 the National DPP lifestyle change program is a Medicaid covered benefit in Oregon. To learn more about their benefit please visit the Oregon Medicaid National DPP benefit site and Oregon’s Requirements for National Diabetes Prevention Program Reimbursement document.

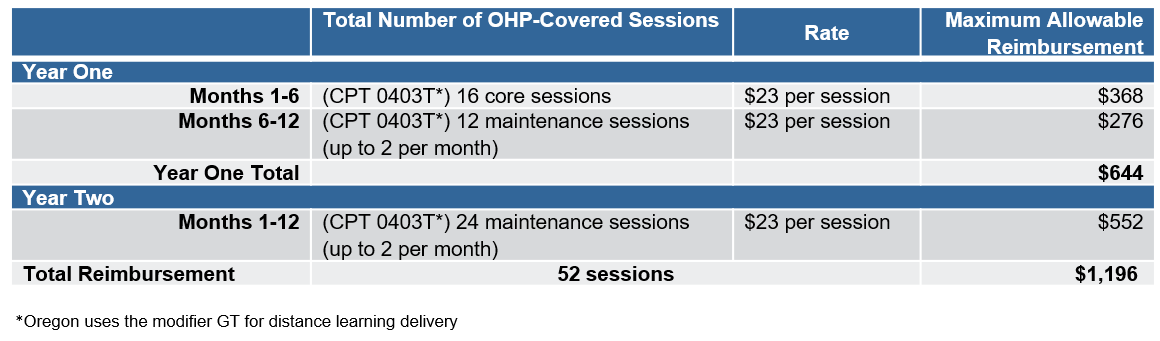

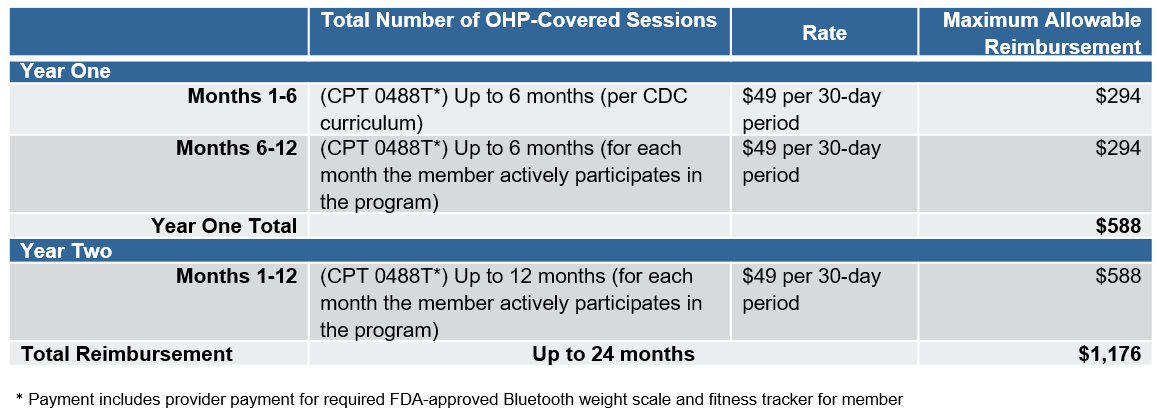

Oregon’s Health Authority reimburses for in-person, distance learning, and online delivery of the National DPP lifestyle change program in fee-for-service Medicaid according to the fee schedule and associated CPT codes below. Oregon uses CPT code 0403T for in-person and distance learning delivery (with modifier GT for distance learning), and code 0488T for online delivery.

HCPCS Codes

About HCPCS Codes

The Healthcare Common Procedure Coding System (HCPCS), is a series of codes used by CMS for medical coding and billing in Medicare and Medicaid. There are three levels of HCPCS codes.

- Level I codes consist of the CPT code set (numeric codes). If Medicare or Medicaid is the payer, the HCPCS code and its modifiers may be used (level III codes listed below).

- Level II codes are the HCPCS (alphanumeric) code set and are primarily concerned with products, supplies, and procedures that are not covered by the CPT codes.

- Level III codes are often referred to as local codes. These are codes that have been developed by state Medicaid agencies and other Medicare and private payers to use in specific programs and jurisdictions. These codes may be included in national reference books but are not nationally recognized as they only apply to the specific area in which they were created.

As with CPT and ICD-10 codes, HCPCS codes can help payers and researchers measure health data, the value of services, quality of care and performance, and how efficiently medical care is delivered.

Applying National DPP HCPCS Codes

CMS outlines the HCPCS codes that should be used to submit claims for Medicare Diabetes Prevention Program (MDPP) services. The CMS Calendar Year MDPP Payment rates (updated annually for inflation) provide a snapshot of the MDPP payment structure and the corresponding G-codes. Please visit the MDPP Basics page to learn more about the MDPP.

HCPCS Codes in Practice: Maryland Medicaid’s HealthChoice Diabetes Prevention Program

Effective September 1, 2019 the National DPP lifestyle change program is available through the HealthChoice Diabetes Prevention Program for Medicaid managed care members in Maryland. To learn more about their benefit please visit the HealthChoice Diabetes Prevention Program site.

Two reimbursement models are available to MCOs in Maryland:

- Session and Performance Based Reimbursement Methodology – Available when the program is delivered in-person, online, or through distance learning.

- Milestone/Bundled Reimbursement Methodology – Only available when the program is delivered online, or through distance learning.

Under the minimum rates for both reimbursement models in Maryland, if a participant in the National DPP lifestyle change program attended all sessions and met all performance outcomes, the total reimbursement the CDC-recognized organization would receive is $670.

The following shows how HCPCS codes are used in Maryland for both reimbursement methodologies.

Session and Performance Based Reimbursement Methodology (available when the program is delivered in-person, online, or through distance learning)

Sessions:

- (G9873) Session 1, 1st core session attended: $100

- (G9874) Sessions 2-4, 4 total core sessions attended: $120

- (G9875) Sessions 5-9, 9 total core sessions attended: $140

- Sessions 10-19, 2 core maintenance sessions attended in months 7-9:

- (G9876) Reimbursement if 5% weight loss goal is not achieved or maintained: $40

- (G9878) Enhanced reimbursement for performance if 5% weight loss goal is achieved or maintained: $80

- Sessions 20-22, 2 core maintenance sessions attended in months 10-12:

- (G9877) Reimbursement if 5% weight loss goal is not achieved or maintained: $40

- (G9879) Enhanced reimbursement for performance if 5% weight loss goal is achieved or maintained: $80

Weight loss performance:

-

- (G9880) 5% weight loss from baseline achieved: $100

- (G9881) 9% weight loss from baseline achieved: $50

Milestone/Bundled Reimbursement Methodology (only available when the program is delivered online, or through distance learning)

Maryland Department of Health permits flexibility in bundled payment distribution across milestones 1-3 and the 5% and 9% performance payouts under this methodology, so long as the total payment per enrollee meets or exceeds $670. Below lists the recommended payment distributions.

Milestones:

- Milestone 1: May be billed at enrollment or initiation into program (0488T); scale is issued (E1639); or 1st core session attended (G9873): $220

- Milestone 2: Billed at 4 core sessions attended (G9874): $160

- Milestone 3: Billed at 9 core sessions attended (G9875): $140

Weight loss performance:

- (G9880) 5% weight loss from baseline achieved: $125

- (G9881) 9% weight loss from baseline achieved: $25

More information regarding reimbursement models can be found on the Reimbursement Models for Medicaid Agencies and MCOs page.

HCPCS Codes in Practice: California’s Medi-Cal

The application of HCPCS codes for the National DPP lifestyle change program through California’s fee-for-service and managed care delivery systems of Medi-Cal can be found on the Reimbursement Models for Medicaid Agencies and MCOs page.

ICD-10 Codes

About ICD-10 Codes

International Classification of Disease (ICD) codes are a group of diagnosis codes used in medical billing. These codes are created and owned by the World Health Organization and managed by the National Center for Health Statistics. The current version of these codes is version 10, so the coding system is referred to as ICD-10. ICD-10 codes describe the patient’s specific diagnosis. They are used to demonstrate to the payer the medical necessity of any procedures or treatments that are performed for that patient.

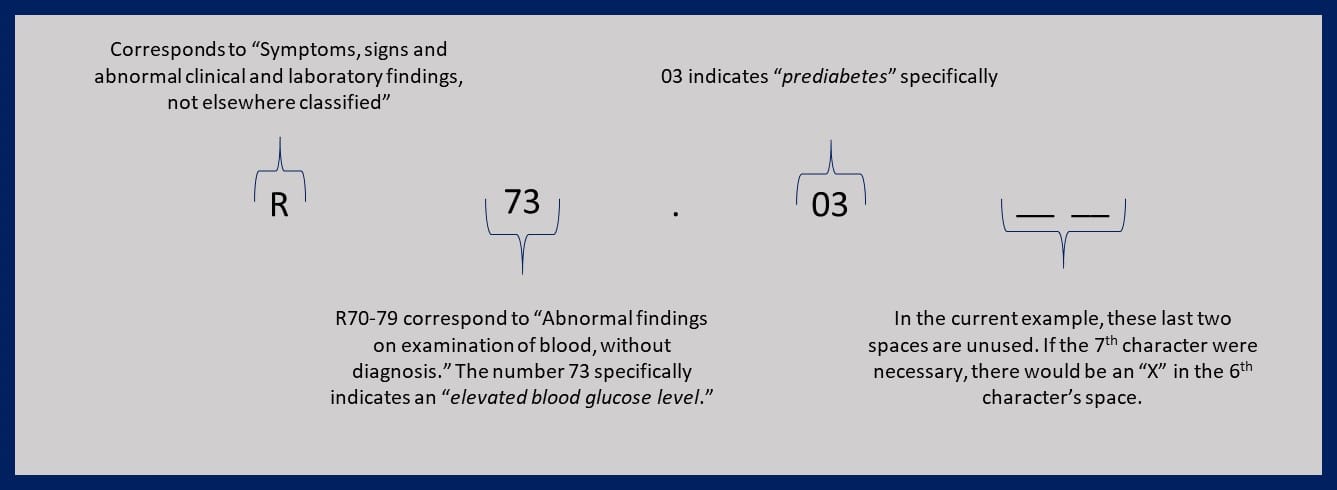

ICD-10 codes will always be in an alphanumeric format (a mix of numbers and letters), have between 3 and 7 characters, and will have a decimal point after the third character. The first character is always a letter; the second and third are always a number. Characters 4 – 7 can be either letters or numbers, but an ICD-10 code will never have more than 7 characters (e.g., A01.0215). These codes often appear complex at first glance, however, they can be broken down into sections, as shown below.

What this breakdown means:

R73.03 = Elevated blood glucose level; prediabetes

How do we get to this description from these numbers and letters? First, each ICD-10 code may have up to 7 characters, so the code could be viewed as: R73.03 __ __. Next, the code can be broken down into each of its parts:

The result is a well-described disease state. Written as a sentence, the code R73.03 could be read as, “Laboratory findings, based upon blood examination, show abnormally elevated blood glucose, in the range associated with prediabetes.”

Understanding the ICD-10 code allows us to compress a long, descriptive sentence into 7 or less characters without losing any of the description. Like CPT codes, ICD-10 codes can help payers and researchers measure health data, the value of services, quality of care and performance, and how efficiently medical care is delivered.

To learn more about ICD codes generally, please see the ICD Code Brief.

Applying ICD-10 Codes to the National DPP

Prediabetes Related ICD-10 Codes

The American Medical Association (AMA), the Centers for Medicare and Medicare Services (CMS), and the CDC have a list of commonly used CPT and ICD codes that can be useful for prediabetes screening. The AMA also provides answers to common CPT questions and documents that can help health care providers determine their appropriate role in helping refer patients to CDC-recognized organizations.

ICD-10 diagnosis codes used to qualify National DPP lifestyle change program participants can vary, depending on the specificity and scope of the eligibility criteria. R73.03 is an ICD-10 code specific to prediabetes. It is anticipated that this code for prediabetes will accommodate broader eligibility criteria. In addition to R73.03, ICD-10 codes for abnormal blood glucose without diabetes can be used (e.g., R73.09, other abnormal glucose).

An important consideration to keep in mind when using ICD-10 codes is that an actual diagnosis of a disease can only be made by a licensed medical provider. If the person providing the National DPP lifestyle change program for a CDC- recognized organization is not a licensed medical provider, they should not use an ICD-10 code specifically related to a diagnosis.

ICD-10 Codes for the Prediabetes Risk Test

CDC-recognized organizations in some states have advocated for an ICD-10 code to indicate when an individual is screened for eligibility to participate in the National DPP lifestyle change program using the online Prediabetes Risk Test. Both Michigan and Illinois are currently testing using Z71.89, the code for “Other Specified Counseling” (which is also used in the Medicare Diabetes Prevention Program (MDPP)). However, since the Prediabetes Risk Test is not actual counseling, it is possible this code may not be the ideal fit. Others have suggested the use of Z13.1, the code for screening for diabetes mellitus, but the Prediabetes Risk Test only screens for prediabetes, and not diabetes mellitus, so Z13.1 may also not be ideal. Another possibility could be that Medicaid selects a Z13.2 code that currently is not being used and only uses that code for the Prediabetes Risk Test. Some examples of Z13.2 codes include Z13.22 screening for metabolic disorders, Z13.228 screening for other metabolic disorders, and Z13.29 encounter for screening for other suspected endocrine disorder.

Invoicing vs. Medical Claims

There are two types of billing options or models that payers can use when covering the National Diabetes Prevention Program (National DPP) lifestyle change program.

- First, payers can contract with CDC-recognized organizations and establish an invoicing method for billing. In this scenario, the CDC-recognized organizations invoice the payer based on the terms defined in the contract.

- Second, CDC-recognized organizations can submit claims either directly to the payer or to the applicable third-party organization that handles billing and/or network management, such as an umbrella hub organization (UHO), the lead organization in an umbrella hub arrangement (UHA).

Whether a claims process is used, or an invoice is sent, CDC-recognized organizations would be required to comply with all HIPAA regulations to ensure participant privacy.

Invoicing

Invoices are often sent on a monthly or other regular basis, as described in the terms of the contract between the CDC-recognized organization and the payer. The payer or third-party organization (if used) will have processes in place to vet invoices and ensure accuracy before remitting the invoice for payment. Details on these processes will be outlined in the contract between the CDC-recognized organization and the payer. One potential role of a UHA is to streamline coding and billing process. For more information, visit the UHA pages of the Coverage Toolkit.

As with all billing options, there are pros and cons to the invoicing approach. Using an invoicing method can be simpler and easier to implement than a claims submission approach. However, the amount of data collected and provided to the payer in an invoice is generally less than what is available in a claims system, which could limit future program evaluation. Whatever approach is selected should align with the current data collection and sharing capabilities of the CDC-recognized organization.

Submitting a Claim

NPI Numbers

The claims submission method requires that the CDC-recognized organization have a National Provider Identifier (NPI) number. The NPI number is a 10-digit number assigned by CMS to HIPAA covered health care providers. Additional information about NPI numbers, including FAQs and information on how to apply for an NPI, can be found on CMS’ website.

Submitting a Claim

If a claims billing method is used, a combination of ICD-10 and CPT (or HCPCS) codes will be assigned to the participant for diagnostic and claims-processing reasons. Claims are commonly submitted via electronic platforms but can also be submitted via paper forms.

To see examples of paper claims forms, please click here.

Many billing methods incorporate some type of pay-for-performance metrics. These metrics may include things such as weight loss goals, number of sessions completed, attendance rates, etc. There are some occasions when a fee for service or a per-member-per-month fee will be utilized without incorporating a performance metric. As coverage of the National DPP lifestyle change program grows, more payers and CDC-recognized organizations are aligning with value-based incentives around weight loss, attendance, and/or other metrics. ICD-10 and CPT code modifiers may be required to bill for these metrics. Please see the Reimbursement Models for Medicaid Agencies and MCOs page or the Reimbursement Models for Commercial Payers page for more information.

As with all billing options, there are pros and cons to the medical claim submission approach. Most but not all payers have a claims-based system and may prefer this approach. However, developing the systems to support this approach can be very labor intensive and require a fair amount of knowledge regarding medical coding. Whatever billing approach is selected should align with the current data and sharing capabilities of the CDC-recognized organization.

For additional information about medical coding software click here.

Considerations for Different Payer Types

Coding and billing requirements may vary slightly between different payers. The table below is meant to help generally inform different payer types in the processes unique to them.

Medicaid Agencies

Medicaid Enrolled Provider Status and Working with CDC-Recognized Organizations

Medicaid agencies must decide who will deliver the National DPP lifestyle change program to Medicaid beneficiaries. States have two options: they can use an existing provider type to deliver the program or they can create a new provider type. It is possible for states to pursue both options at the same time or to pursue one approach first and another approach later. For more information, see the Determining the Medicaid Enrolled Provider Type page of the Coverage Toolkit.

Requirements for Medicaid provider enrollment vary by state. CDC-recognized organizations who are interested in becoming Medicaid enrolled providers should contact their state Medicaid agency to understand the requirements to enroll. To bill Medicaid, CDC-recognized organizations should have, at minimum:

- Billing systems in place (processes, people, technology) to submit claims, and

- An assigned National Provider Identifier (NPI) number to enroll as a provider/supplier with the Medicaid agency.

CDC-recognized organizations that desire to bill Medicaid may already have an NPI number, as an NPI is required for other billing methods, such as billing a commercial plan and Medicare. For more information about the NPI number, see the “Submitting a Claim” section above.

Medicaid Eligibility Verification

CDC-recognized organizations who enroll with Medicaid to offer the National DPP lifestyle change program will need to verify Medicaid eligibility for their Medicaid patients. If the individuals/organizations providing the National DPP lifestyle change program are not enrolled Medicaid providers, which may occur if the CDC-recognized organization is participating in a pilot or demonstration, they may need to find a way to confirm patient eligibility other than directly accessing a Medicaid Eligibility Verification System.

Fee Schedule

States who cover the National DPP lifestyle change program as a Medicaid benefit may consider adding the program to their fee schedule. Example fee schedules that include the reimbursement rates for the National DPP lifestyle change program are summarized on the Reimbursement Models for Medicaid Agencies and MCOs page.

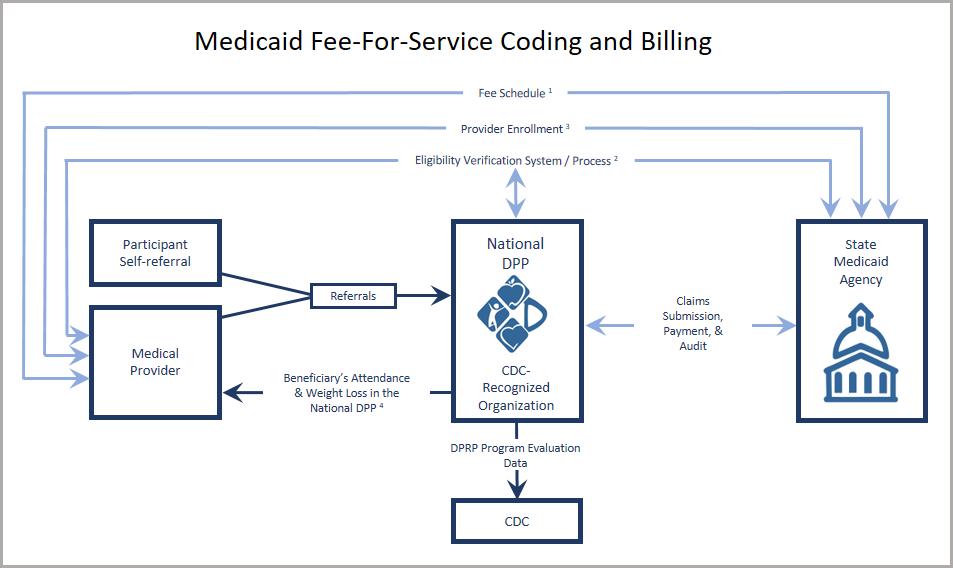

Medicaid Fee-for-Service Coding and Billing Diagram

The following diagram depicts the interactions that may occur between key stakeholders when coding and billing for the National DPP lifestyle change program.

- Fee schedule utilized if the National DPP lifestyle change program is a covered benefit. Claims are sent directly to the state Medicaid agency.

- CDC-recognized organizations must be enrolled as Medicaid providers to have access to the Eligibility Verification System. Medicaid eligibility should be confirmed prior to each class.

- Provider enrolls with the Medicaid agency (enrollment varies based on the determined provider type).

- Experience has shown that provider referrals and sharing National DPP lifestyle change program results with a participant’s primary care provider can increase program enrollment and retention.

The diagram above represents the flow of information (clinical, data, economic, etc.) among various entities, assuming the National DPP lifestyle change program is a covered Medicaid benefit.

Medicaid MCOs

Medicaid Enrolled Provider Status and Working with CDC-Recognized Organizations

Medicaid agencies determine who will deliver the National DPP lifestyle change program to Medicaid beneficiaries. States have two options: they can use an existing provider type to deliver the program or they can create a new provider type. It is possible for states to pursue both options at the same time or to pursue one approach first and another approach later. For more information, see the Determining the Medicaid Enrolled Provider Type page of the Coverage Toolkit.

When using a claims-based billing system, managed care organizations (MCOs) will need to ensure that the CDC-recognized organizations they contract with are able to submit claims. Therefore, CDC-recognized organizations should have:

- Billing systems in place (staff to process paper claims or an electronic system) to submit claims; and

- An assigned National Provider Identifier (NPI) number to enroll as a provider/supplier with the Medicaid agencies and/or MCO (most CDC-recognized organizations have separate organization-level NPIs for each facility offering the National DPP lifestyle change program); and

- Negotiated a rate for services with the MCO.

Medicaid Eligibility Verification

CDC-recognized organizations will need to verify Medicaid eligibility for their Medicaid patients. If the individuals/organizations providing the National DPP lifestyle change program are not enrolled Medicaid providers, which may occur if the CDC-recognized organization is participating in a pilot or demonstration, they may need to find a way to confirm patient eligibility other than directly accessing a Medicaid Eligibility Verification System.

Fee Schedule

If the National DPP lifestyle change program was a covered Medicaid benefit in the state, the state Medicaid agency would likely incorporate the program into their fee schedule. Example fee schedules that include the reimbursements rates for the National DPP lifestyle change program are summarized on the Reimbursement Models for Medicaid Agencies and MCOs page.

Contracts between CDC-Recognized Organizations and MCOs

Contracts and data sharing agreements need to be in place between CDC-recognized organizations and MCOs to set the terms of the engagement, whether a demonstration or another funding approach is used, and ensure that both parties are protected from legal liability. For more information on the contracting process, please see the Contracting with CDC-Recognized Organizations page.

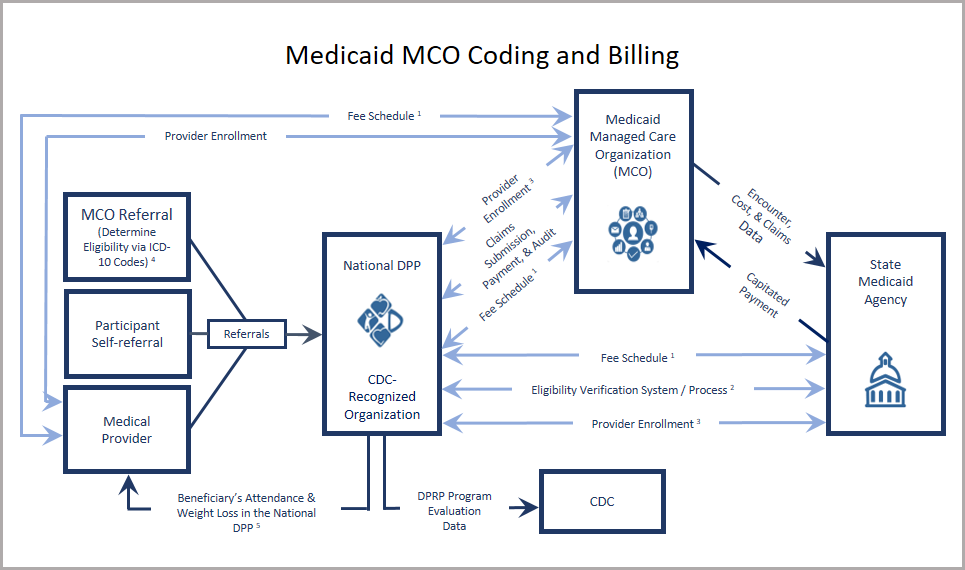

Medicaid MCO Coding and Billing Diagram

The following diagram depicts the interactions that may occur between key stakeholders when coding and billing for the National DPP lifestyle change program.

- Fee schedule utilized if the National DPP lifestyle change program is a covered benefit. Claims are sent directly to the state Medicaid agency.

- CDC-recognized organizations must be enrolled as Medicaid providers to have access to the Eligibility Verification System. Medicaid eligibility should be confirmed prior to each class.

- Provider enrolls with the Medicaid agency and the MCO (enrollment varies based on the determined provider type and associated credentialing process). For more information, see the Determining the Medicaid Enrolled Provider Type page of the Coverage Toolkit.

- Experience has shown that provider referrals and sharing National DPP lifestyle change program results with a participant’s primary care provider can increase program enrollment and retention.

The diagram above represents the flow of information (clinical, data, economic, etc.) among various entities assuming the National DPP lifestyle change program is a covered Medicaid benefit.

Commercial Plans

Working with CDC-Recognized Organizations

When using a claims-based billing system, commercial plans and employers will need to ensure that the CDC-recognized organizations they contract with are able to submit claims or invoice appropriately. CDC-recognized organizations should have:

- Billing systems in place (staff to process paper claims or an electronic system) to submit claims;

- An assigned National Provider Identifier (NPI) number; and

- A negotiated rate for services with the commercial plan or employer, as reflected on the plan’s fee schedule.

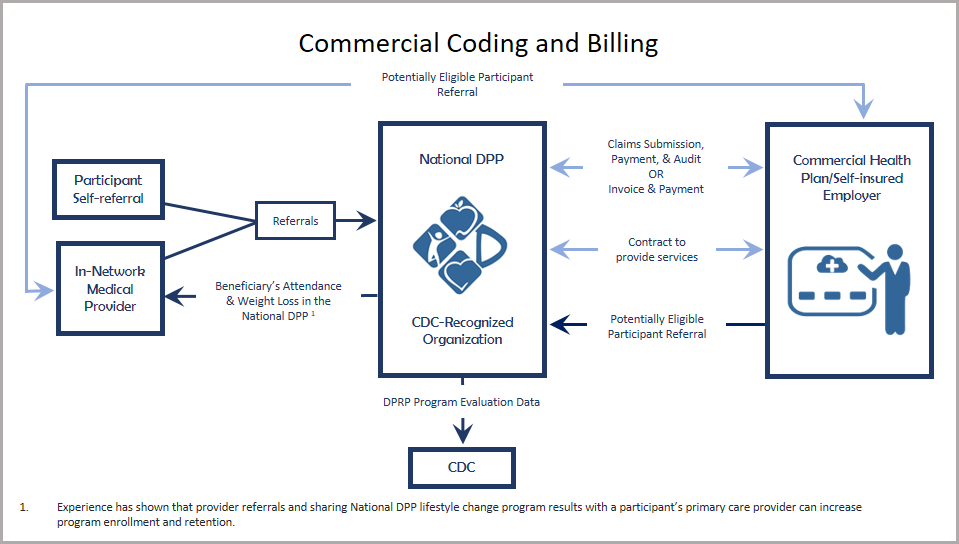

Commercial Plans Coding and Billing Diagram

The following diagram depicts the interactions that may occur between key stakeholders when coding and billing for the National DPP lifestyle change program.

MA Plans

MDPP

Coding and billing for the Medicare Diabetes Prevention Program (MDPP) should occur according to the MDPP quick reference guide to payment and billing, provided by the Centers for Medicare and Medicaid Services (CMS). This document describes the fifteen appropriate HCPCS G-codes required to bill for the MDPP as well as the reimbursement rates, including performance metrics, and timing of payments. If there are additional questions regarding coding and billing for the MDPP, Medicaid Advantage Plans should refer to the Center for Medicare and Medicaid Innovation Medicare Diabetes Prevention Program (MDPP) site or visit the MDPP Supplier Support Center. Additional information regarding coding and billing can be found on the MDPP FAQ page.