Medicaid → Fiscal Operations → Reimbursement Models for Medicaid Agencies and MCOs

Reimbursement Models for Medicaid Agencies and MCOs

The information below about cost and reimbursement for the National Diabetes Prevention Program (National DPP) lifestyle change program can inform Medicaid Agency and Medicaid managed care organizations (MCO) rate-setting and design delivery. See the Cost and Value page for more information about analyzing the cost of covering the program. This Reimbursement page also outlines how the National DPP lifestyle change program can be accounted for in insurers’ Medical Loss Ratio calculation.

- Costs

- Costs in Practice

- Reimbursement Models

- Reimbursement Models in Practice

- Summary Reimbursement Table

- Medicaid Eligibility and Churn

- Centers for Medicare and Medicaid Services Medicaid ‘Free Care’ Guidance

- Rate Setting

- Medical Loss Ratio

Costs

Program costs are an important part of the equation when determining reimbursement rates. It could be useful to benchmark program costs by using the most current CMS Calendar Year MDPP Payment Rates, which are updated annually for inflation. In addition to the per participant cost of delivering the program, it may cost as much as an additional $500 per participant for program costs related to removing barriers to participation, providing program supports, addressing health-related social needs, etc. Organizations interested in delivering the National DPP lifestyle change program as a CDC-recognized organization can use the American Medical Association’s National DPP Lifestyle Change Program Budget Considerations Tool to estimate the cost of delivering the program.

Activities that drive program costs include facility fees and direct program delivery costs such as staffing costs. Some of these delivery costs may be higher in a Medicaid context than in other populations. For example, because the population can be more transient, it may be more time- and labor-intensive to reach potential participants and determine their eligibility. In addition, transportation is more likely to be a barrier to participation and program retention than for other populations, and Lifestyle Coaches may need to spend more time outside of actual classes to follow up with participants and to ensure that they continue to participate.

The Budget Projection Template (click the icon to download) can be used by payers to estimate the total cost of covering the National DPP lifestyle change program for eligible beneficiaries, as well as the average cost per participant. The Medicaid Budget Projection Template Instructions (click the icon to open) is meant to be used alongside the Budget Projection Template to help the user identify the decisions and data needed. It also explains how to interpret the results of the Budget Projection Template.

Costs in Practice

Denver Health

The Community Epidemiology and Program Evaluation Group conducted a cost analysis of the National DPP lifestyle change program at Denver Health in 2015, which was compiled in a report prepared for the State of Colorado. Micro-costing and program information for the Denver Health National DPP lifestyle change program was provided by Denver Health for costs incurred from October 2012 to the end of calendar year 2014. Nearly half of the program participants were Medicaid beneficiaries. Component costs included the following:

- Community health worker (CHW)/lifestyle coach staffing

- Program management and supervision

- Other program support staff

- Training

- HR costs

- Other direct costs

- Facility and other indirect costs

- Program development costs

The evaluation authors estimated that costs equaled $552 per participant who attended at least one session, and $1,428 per participant who attended at least nine sessions. About 50% of the cost was attributable to coach staffing, and another 19% to program management and supervision. The remaining 25% was attributable to facility and other indirect costs. Program development costs constituted a relatively small percentage.

Medicaid Demonstration

During the Medicaid Coverage for the National DPP Demonstration Project, a cost study of state agency, managed care organization (MCO) or coordinated care organization (CCO), and CDC-recognized organization costs were completed. A breakdown of the percentage of costs that were associated with administrative, recruitment, retention, data collection, and delivery activities for the National DPP lifestyle change program can be found here. The average cost to established CDC-recognized organizations to deliver the program was $1,529 per program participant and the average cost to new CDC-recognized organizations was $1,704 per program participant. The average cost to online CDC-recognized organizations to deliver the program was $556 per program participant.

Montana

A program manager from the Montana Department of Public Health and Human Services (Montana DPHHS) indicated the following about their reimbursement rate relative to actual cost:

“The $500 covers the basic education, the facility cost, and interactions between the coach and the participants. It may not cover some extra services which may be financed by in-kind contributions or donations. A lot of the DPP provider organizations add different value-added services such as a gym membership. Montana Medicaid has a benefit so that a beneficiary can call to get a ride or can secure reimbursement for gas. To address child care needs, we have not yet found a universal solution, but some facilities have onsite child care (e.g., YMCA). A few sites have provided incentives.”

Direct medical costs for the original DPP clinical trial were $2,780 per participant over three years. However, this featured an individual (rather than group) coaching model facilitated by case managers.

YMCA

The YMCA program fee is $429 for the yearlong program. Consumers pay in a variety of ways, and YMCAs work with them if financial assistance is needed. Some payers pay a flat $429 fee regardless of how much of the program a participant completes. For claims-based reimbursement, a performance-based fee schedule is used, and payers pay claims based on the achievement of specific milestones. Average cost for the program are comprised of fixed and variable costs. When there are more participants in the program to absorb the fixed costs, the average cost can be substantially lower, but volume is key.

Under certain circumstances, individuals may be able to cover their portion of participation costs with their Health Savings Account (HSA). See the tab titled “Using HSA Dollars to Pay for the Program” in the About Employer Health Insurance section on the Coverage in Practice page for more information.

Reimbursement Models

To date, payers covering (or proposing coverage) of the National DPP lifestyle change program have provided reimbursement using one or a combination of the following methods:

- Fee-for-service: reimbursement on a per session basis

- Attendance Milestone: variable reimbursement provided after multiple sessions have been completed (e.g., 1st session, 4th session, 9th session, 16th session)

- Performance-based model: offering different reimbursement levels based on outcomes, such as weight loss and weight loss maintenance.

- Combination: using a combination of the fee-for-service, attendance milestone, and/or performance-based models.

Reimbursement Models in Practice

California

In the fee-for-service and managed care delivery systems of Medi-Cal, Californa uses a combination of an attendance milestone and performance-based approach to reimburse for the National DPP lifestyle change program as outlined below. The Healthcare Common Procedure Coding System (HCPCS) codes are listed in parenthesis (for more information about HCPCS codes, see the Coding and Billing page). California also covers the program in Medi-Cal through the managed care delivery system. For more information, see the California State Story.

For a Medi-Cal eligible participant in the National DPP lifestyle change program that attends all sessions for the two-year program and attains all the weight loss goals, the CDC-recognized organization would receive a total reimbursement of $536.

Sessions:

- Core Sessions Months 1-6:

- (G9873) 1st session attended – $20

- (G9874) 4 sessions attended – $40

- (G9875) 9 sessions attended – $72

- Core Maintenance with 5% weight loss:

- (G9878) 2 sessions attended in months 7-9 – $48

- (G9879) 2 sessions attended in months 10-12 – $48

- Core Maintenance without 5% weight loss:

- (G9876) 2 sessions attended in months 7-9 – $12

- (G9877) 2 sessions attended in months 10-12 – $12

- Ongoing Maintenance Months 13-24: Maintained 5% weight loss and attended 2 sessions every 3 months

- (G9882) Months 13-15 – $40

- (G9883) Months 16-18 – $40

- (G9884) Months 19-21 – $40

- (G9885) Months 22-24 – $40

Weight Loss Performance:

- (G9880) achieved 5% weight loss OR had absolute reduction of waist circumference by 3.2 cm during months 1-12 – $128

- (G9881) achieved 9% weight loss during months 1-24 – $20

Bridge Payment for Transitioning from a Different DPP Provider:

- (G9890) Months 1-24 for first DPP core session, core maintenance session, or ongoing maintenance session – $20

Illinois

Effective August 1, 2021, the National DPP lifestyle change program is available to eligible Medicaid beneficiaries in Illinois between the ages of 18 – 64. On February 4, 2022, CMS approved the state plan amendment (SPA) that includes the National DPP lifestyle change program and Diabetes Self-Management Education and Support (DSMES) services in the Illinois Medicaid State Plan.

The Illinois Medicaid rates for reimbursement for the National DPP lifestyle change program are session and performance-based for both in-person and online programs. For virtual or telehealth sessions a GT modifier can be used as well as a VM modifier for make-up sessions. The billing codes can only be used once every 365 days. Maximum Medicaid reimbursement for the National DPP lifestyle change program in Illinois is $670 per member.

The reimbursement is broken down by a series of milestones as follows:

- (G9873) $180 per-member reimbursement

Milestone 2: Attending 4 core sessions

- (G9874) $150 per-member reimbursement

Milestone 3: Attending 9 core sessions

- (G9875) $140 per-member reimbursement

Milestone 4: Attending 2 core sessions in months 7-9

- Without 5% weight loss:

- (G9876) $30 per-member reimbursement

- With 5% weight loss:

- (G9878) $50 per-member reimbursement

Milestone 5: Attending 2 core sessions in months 10-12

- Without 5% weight loss:

- (G9877) $30 per-member reimbursement

- With 5% weight loss:

- (G9879) $50 per-member reimbursement

Performance: Achieve 5% weight loss from baseline

- (G9880) $100 per-member reimbursement

For further information reference the Provider Notice. To learn more about Illinois’ Medicaid coverage for the National DPP lifestyle change program, visit the Illinois State Story of Medicaid Coverage page of the Coverage Toolkit.

Maine

Effective January 1, 2024, MaineCare (Maine’s Medicaid program), reimburses for the National DPP lifestyle change program in-person, online, and via distance learning. MaineCare’s benefit manual details that reimbursement is based on a session-based rate and a performance payment, as follows:

Session Rate. The allowed amount for each National DPP LCP session is 100% of Medicare’s current total reimbursement for all sessions without weight loss included in the MDPP divided by the total number of sessions required by the most current version of the DPRP Standards.

- Per session reimbursement without performance-based payments: $25/session

- Total reimbursement per client per one-year program of 22 sessions without performance-based payments: $550

Performance Payment. The allowed amount for each performance payment is 100% of Medicare’s current maximum reimbursement for additional payments related to weight loss in the MDPP divided by two (2).

- Per session reimbursement when performance payments are factored in: $34.91/session

- Total reimbursement per client per one-year program of 22 session with performance-based payment: $768

Maryland

Effective September 1, 2019 the National DPP lifestyle change program is available through the HealthChoice Diabetes Prevention Program for Medicaid managed care members in Maryland. To learn more about their benefit please visit the HealthChoice Diabetes Prevention Program site.

Two reimbursement models are available to MCOs in Maryland.

- Session and Performance Based Reimbursement Methodology – Available when the program is delivered in-person, online, or through distance learning.

- Milestone/Bundled Reimbursement Methodology (only available when the program is delivered online, or through distance learning).

Maryland Department of Health intends to require MCOs to pay contracted CDC-recognized organizations that administer the National DPP lifestyle change program at least the minimum rates listed below, which are outlined in the Policy Transmittal and the HealthChoice Diabetes Prevention Program Manual. The HCPCS codes are listed in parenthesis (for more information about HCPCS codes, see the Coding and Billing page).

Under the minimum rates for both reimbursement models in Maryland, if a participant in the National DPP lifestyle change program attended all sessions and met all performance outcomes, the total reimbursement the CDC-recognized organization would receive is $670.

Session and Performance Based Reimbursement Methodology (available when the program is delivered in-person, online, or through distance learning)

Sessions:

- (G9873) Session 1, 1st core session attended: $100

- (G9874) Sessions 2-4, 4 total core sessions attended: $120

- (G9875) Sessions 5-9, 9 total core sessions attended: $140

- Sessions 10-19, 2 core maintenance sessions attended in months 7-9:

- (G9876) Reimbursement if 5% weight loss goal is not achieved or maintained: $40

- (G9878) Enhanced reimbursement for performance if 5% weight loss goal is achieved or maintained: $80

- Sessions 20-22, 2 core maintenance sessions attended in months 10-12:

- (G9877) Reimbursement if 5% weight loss goal is not achieved or maintained: $40

- (G9879) Enhanced reimbursement for performance if 5% weight loss goal is achieved or maintained: $80

Weight loss performance:

-

- (G9880) 5% weight loss from baseline achieved: $100

- (G9881) 9% weight loss from baseline achieved: $50

Milestone/Bundled Reimbursement Methodology (only available when the program is delivered online, or through distance learning)

Maryland Department of Health permits flexibility in bundled payment distribution across milestones 1-3 and the 5% and 9% performance payouts under this methodology, so long as the total payment per enrollee meets or exceeds $670. Below lists the recommended payment distributions.

Milestones:

- Milestone 1: May be billed at enrollment or initiation into program (0488T); scale is issued (E1639); or 1st core session attended (G9873): $220

- Milestone 2: Billed at 4 core sessions attended (G9874): $160

- Milestone 3: Billed at 9 core sessions attended (G9875): $140

Weight loss performance:

- (G9880) 5% weight loss from baseline achieved: $125

- (G9881) 9% weight loss from baseline achieved: $25

Michigan

Effective July 2023, the Michigan Department of Health and Human Services set the following fee schedule to reimburse for the Michigan Diabetes Prevention Program (MiDPP):

- Core Sessions Months 1-6

- G9873 Attend 1 core session: $38.00

- G9874 Attend 4 core sessions: $115.00

- G9875 Attend 9 core sessions: $191.00

- (Months 7-9)

- G9876 Attend 2 core maintenance sessions – No 5% weight loss: $76.00

- G9878 Attend 2 core maintenance sessions – Achieves 5% weight loss: $101.00

- (Months 10-12)

- G9877 Attend 2 core maintenance sessions – No 5% weight loss: $76.00

- G9879 Attend 2 core maintenance sessions – Achieves 5% weight loss: $101.00

- Other G9891 Non-payable code to indicate session date to qualify for a payment attendance milestone.

- Allowable one time only during a beneficiary MiDPP series:

- G9880 5% weight loss achieved from baseline weight: $184.00

- G9881 9% weight loss achieved from baseline weight: $38.00

- G9890 Bridge payment – one per lifetime per billing NPI: $38.00

Total possible reimbursement per participant: $768 (not including Bridge payment)

For more information, see Michigan’s State Story of Medicaid Coverage on the Coverage Toolkit.

Minnesota

The Minnesota Department of Human Services reimburses for the National DPP lifestyle change program for fee-for-service beneficiaries according to the following schedule:

$13.62/session (core and maintenance) ($300 for 22 sessions)

To learn more about Minnesota’s coverage of the National DPP lifestyle change program, visit the Minnesota State Story of Medicaid Coverage.

Missouri

On September 1, 2020, the Missouri HealthNet Division (MHD) instituted coverage of the National DPP lifestyle change program for eligible Medicaid beneficiaries age 21 or older. Reimbursement is set at $19.23 per session.

In year one, there can be up to a maximum of 26 sessions for months 1 through 12 (a total Medicaid reimbursement of $499.98). In year two, there can be up to a maximum of four sessions for months 13 through 24 (an additional Medicaid reimbursement of up to $76.92).

The reimbursement is broken down as follows:

- Core Services Sessions

- (0403T) $19.23 per session/unit – Preventive behavior change, intensive program of prevention of diabetes using a standardized National DPP curriculum, provided to individuals in a group setting, minimum sixty (60) minutes, per day.

- Ongoing Maintenance Services Sessions

- (99412) $19.23 per session/unit – Preventive Medicine Service, group counseling for ongoing maintenance.

To learn more about their benefit please reference the Provider Notice and the Missouri example on the Attaining Coverage through a Medicaid State Plan page of the Coverage Toolkit.

Montana

Montana Medicaid reimburses for the National DPP lifestyle change program according to the following schedule:

- $29.10 per weekly session in first six months ($465.60 total for completion of all 16 weekly sessions)

- $29.10 per monthly session in last six months ($174.60 total for completion of all 6 monthly sessions)

For a Medicaid eligible participant that attended all sessions, the CDC-recognized organization would be reimbursed $640.20. To learn more about Montana’s approach to coverage of the National DPP lifestyle change program, visit the Montana State Story page.

New York

On April 12, 2019, the New York State (NYS) legislature amended its social services law to include the National DPP lifestyle change program within the definition of “standard coverage” for medical assistance for needy persons. Amending the social services law also authorized CDC-recognized organizations to enroll in NYS Medicaid and receive Medicaid reimbursement.

To secure federal Medicaid matching funds for the program NYS Medicaid submitted a Medicaid State Plan Amendment (SPA) to the Centers for Medicare and Medicaid Services (CMS) on June 28, 2019, which was expeditiously approved by CMS on September 4, 2019. To learn more about NYS’s pathway to Medicaid coverage, visit the New York’s State Story of Medicaid Coverage page of the Coverage Toolkit.

The NYS SPA outlines that the Medicaid fee-for-service (FFS) rate for the National DPP lifestyle change program is 80 percent of the max 2019 two-year Medicare National DPP lifestyle change program rate ($689). This results in a maximum reimbursement of $551 per member over 22 total sessions. However, NYS has rounded each session payment up to the nearest dollar, resulting in a maximum reimbursement amount of $554 per member. The $554 is broken down in as follows:

- (0403T) – This is a $22.00 per-member, per-session reimbursement for members who attend in-person National DPP lifestyle change program group sessions. This reimbursement is not tied to weight loss benchmarks.

- (G9880) – This is a $70.00 incentive payment that is awarded to providers for members that have achieved at least 5% weight loss from their baseline. This provider incentive payment is available only once to the provider over the course of the 22 sessions when the member first achieves the 5% weight loss from baseline. If the Medicaid member re–enrolls in a new National DPP lifestyle change program cohort at a later time, this incentive payment will be available again to the provider when the member achieves at least a 5% weight loss from the new baseline.

Additional information on NYS related to reimbursement can be found in the New York State Medicaid DPP FFS Policy and Billing Guidelines.

Ohio

Reimbursement Models in Practice

Effective January 1, 2022, the National DPP lifestyle change program is a Medicaid covered benefit in Ohio.

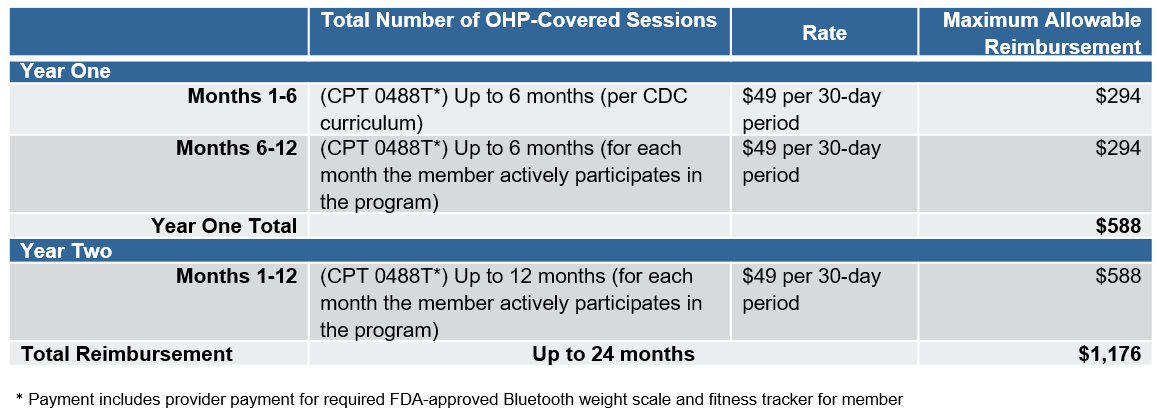

Ohio Department of Medicaid reimburses for the in-person and online delivery of the National DPP lifestyle change program in fee-for-service Medicaid according to the fee schedules below, with a lifetime maximum of 52 billable, one-hour sessions. The standard reimbursement the CDC-recognized organization would receive for in-person delivery over a two-year period is $920, and over a one-year period it is $644. For online delivery, maximum reimbursement over a two-year period is $1,176, and over a one-year period is $588.

- Year One

- Months 1-6 (16 sessions): $23.00 per day/per session

- Months 6-12 (12 sessions): $23.00 per day/per session

- Year Two

- Months 1-12 (12 sessions): $23.00 per day/per session

- Years One & Two

- Months 1-24: $49.00 per month

Services furnished by a Federally Qualified Health Center (FQHC) or Rural Health Clinic (RHC) are paid under the Prospective Payment System at the FQHC’s or RHC’s pre-established per visit payment amount in accordance with Chapter 5160-28 of the Ohio Rule. Additional information on the benefit reimbursement can be found in the Ohio Department of Medicaid Transmittal Letter No. 336-24-15.

Oregon

Effective January 1, 2019 the National DPP lifestyle change program is a Medicaid covered benefit in Oregon. To learn more about their benefit please visit the Oregon Medicaid National DPP benefit site and Oregon’s Requirements for National Diabetes Prevention Program Reimbursement document.

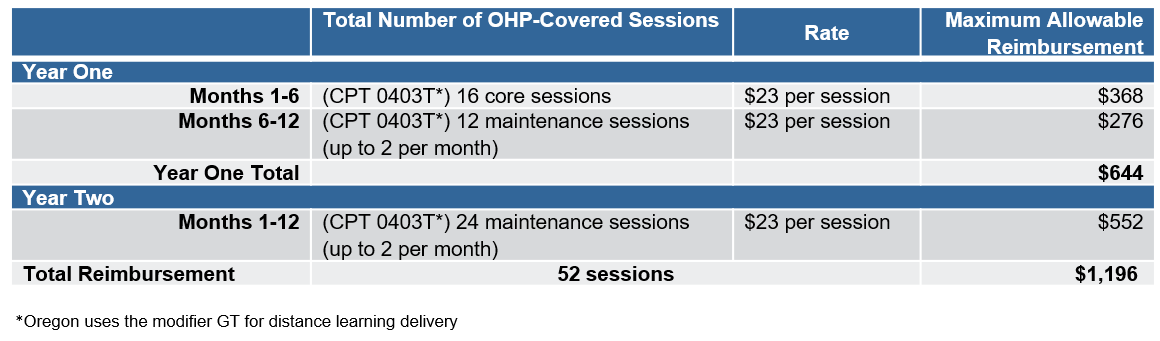

Oregon’s Health Authority (OHA) reimburses for the in-person, distance learning (a remote two-way telehealth class), and online delivery of the National DPP lifestyle change program in fee-for-service Medicaid according to the fee schedules below. The maximum reimbursement the CDC-recognized organization would receive for in-person or distance learning delivery over a two-year period is $1,196, and over a one-year period it is $644. For online delivery, the maximum reimbursement over a two-year period is $1,176, and over a one-year period is $588.

In-Person or Distance Learning:

OHA also produced a guide for coordinated care organizations (CCOs) to implement the National DPP lifestyle change program, which includes recommendations for determining a reimbursement methodology for CCOs (see pages 28-30).

South Dakota

Effective April 1, 2019, the National DPP lifestyle change program is a reimbursable service through Community Health Worker (CHW) Services within South Dakota Medicaid. Lifestyle Coaches seeking reimbursement are required to be employed and supervised by a South Dakota Medicaid-enrolled CHW agency. The National DPP lifestyle change program sessions are billed using the following CPT codes:

- 98960 – Self-management education & training 1 patient, 30 minutes: $30.89

- 98961 – Self-management education & training 2-4 patients, 30 minutes: $15.45/patient

- 98962 – Self-management education & training 5-8 patients, 30 minutes: $10.81/patient

One unit is equal to 30 minutes. When sessions are one hour in length, which is typical of the National DPP lifestyle change program, two units can be billed. Reimbursement is not tied to weight loss benchmarks and the program can be delivered in-person or online. To learn more on National DPP reimbursement and CHW services see South Dakota’s Medicaid Billing and Policy Manual.

Since reimbursement in South Dakota is based on length of time and the number of beneficiaries served, the following example offers a likely scenario for a typical cohort convening for 22 total sessions (16 weekly sessions, 6 monthly sessions).

- Seven patients served and one hour total instruction time, on average: $10.81 x 2 units x 7 patients x 22 sessions = $3,329.48 = $475.64 per participant

Utah

Effective July 1, 2022, Utah Medicaid reimburses for the National DPP lifestyle change program online and in-person according to the following schedule:

- $26.45 per session ($581.90 for 22 sessions)

Wyoming

Beginning in January 2020, Wyoming Medicaid opened codes allowing registered dieticians to be reimbursed for delivering the National DPP lifestyle change program to Medicaid beneficiaries. Wyoming is a fee-for-service (FFS) state and reimburses for the National DPP lifestyle change program according to the following schedule:

$19.00/session (core and maintenance) ($418 for 22 sessions)

To learn more about Wyoming’s reimbursement of the National DPP lifestyle change program, see the Wyoming example on the Attaining Coverage through a Medicaid State Plan page of the Coverage Toolkit.

MDPP Expanded Model

The Medicare Diabetes Prevention Program (MDPP) expanded model allows Medicare beneficiaries to access evidence-based diabetes prevention services with the goal of a lower rate of progression to type 2 diabetes, improved health, and reduced spending. To learn more, please visit the Center for Medicare and Medicaid Innovation MDPP site. Additional information is also available on the MDPP Basics page of the Coverage Toolkit.

MDPP services are paid for using both a fee-for-service and performance-based payment methodology that is updated annually for inflation. The current payment rates can be found here: CMS Calendar Year MDPP Payment Rates.

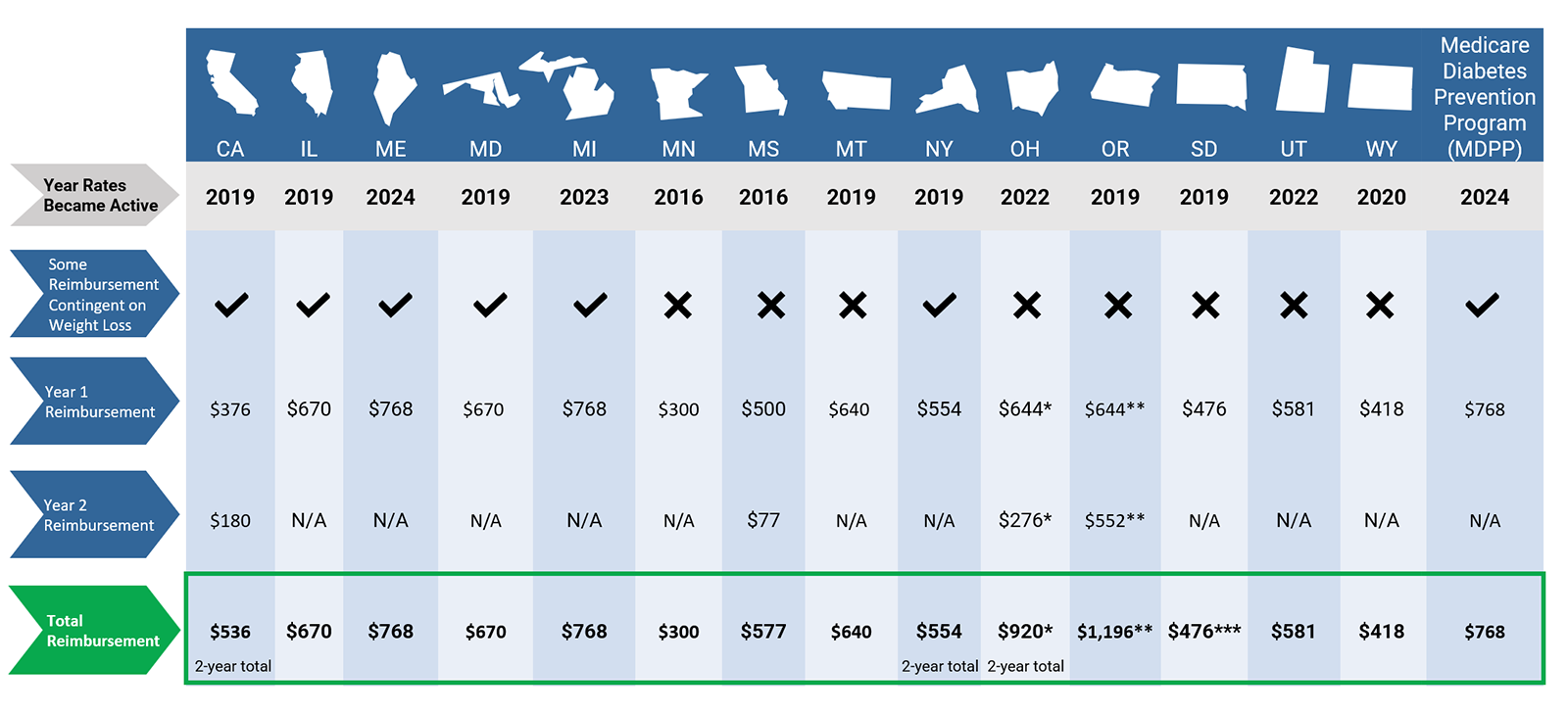

Summary Reimbursement Table

Content last updated: February 29, 2024

* The reimbursement amounts in the chart for Ohio are for in-person delivery. The maximum possible reimbursement for online delivery in Ohio is $588 in year 1 and $588 in year 2, making a total of $1,176 for both year 1 and year 2.

** The reimbursement amounts in the chart for Oregon are for in-person and distance learning delivery. The maximum possible reimbursement for online delivery in Oregon is $588 in year 1 and $588 in year 2, making a total of $1,176 for both year 1 and year 2.

*** Total reimbursement varies based on total instruction time and number of beneficiaries served. See example in tabbed table for details on how total reimbursement is calculated.

Print Summary Reimbursement Table

Medicaid Eligibility and Churn

Individuals move in and out of Medicaid eligibility frequently due to changing financial status or other reasons, often administrative in nature, that disqualify them for continuing coverage. This movement in and out of Medicaid coverage is often referred to as churn and can be a challenge for a year-long program like the National DPP lifestyle change program. Medicaid churn rates are dependent on the qualifying level of income for Medicaid eligibility and vary substantially by state. A study from KFF based on people enrolled in Medicaid in 2018 found ranges from 5% or less in some states to 15% or more in others. A study from Medicaid and Chip Payment and Access Commission (MACPAC) from the same period found that overall, about 8% of full-benefit Medicaid and CHIP beneficiaries disenrolled and re-enrolled within a year. MACPAC also found substantial state variation that appeared to be explained in part by state policy differences, including 12-month continuous eligibility, conducting mid-year eligibility checks, and use of automated renewals using available information from other sources. It may be advisable that agencies interested in addressing the impact of churn on program implementation conduct state-specific research to better understand its relevance for their Medicaid population and health plans, and if state policies may be playing a role.

Beyond churn, there are many possible status changes that can occur for an individual that may impact their ability to participate in the program. Below are some potential scenarios that should be considered as state Medicaid agencies and MCOs develop policies and procedures for providing National DPP lifestyle change program services. In these scenarios, a current lifestyle change program participant:

- Loses Medicaid coverage (permanently or temporarily)

- Switches between Medicaid MCOs or health plans

- Moves from fee-for-service to an MCO (or vice versa)

- Moves from Medicaid to Medicare

- Moves from Medicaid to a commercial plan

Although policies will vary by state and by entity, a few key considerations may help states and partners prepare to navigate churn and status change:

- Payer-to-payer coverage: If a current program participant is moving within Medicaid (between fee-for-service and managed care or between MCOs/health plans), to a commercial payer, or to a different state, reimbursement is contingent on coverage being in place for the new payer and the benefit covering the delivery modality (i.e., in-person, online, combination, etc.).

- Enrolled, credentialed, and contracted providers: If coverage is in place for a new payer, a participant may need to move to a new provider of the National DPP lifestyle change program if their current CDC-recognized organization is not enrolled, credentialed, and/or contracted with the new payer or if the delivery type (i.e., in-person, online, combination, etc.) is not covered.

- Re-starting the program: Some payers, including Medicare, will not allow a participant to switch into a new program mid-way; if a participant becomes eligible for Medicare while enrolled in the lifestyle change program under a different payer or via self-pay, they will need to restart the program with an MDPP supplier in order to receive the Medicare benefit.

Medicaid agencies, MCOs, health plans, and CDC-recognized organizations may consider different approaches to address or lessen the burden of churn, both in general and when covering or offering the National DPP lifestyle change program. Please note that Medicaid policies will vary from state to state; the following are ideas that may be considered or adapted.

- Umbrella hub arrangements (UHAs) and Community Care Hubs (CCHs): UHAs and CCHs may offer an opportunity for participants to continue the lifestyle change program and other evidence-based programs without interruption, as these entities may hold contracts with a variety of payers including Medicaid, MCOs, and commercial health plans. Organizations that are a part of these entities may also be able to leverage various funding sources, which could provide options for continued program delivery if an individual’s Medicaid coverage is suspended. See the Umbrella Hub Arrangements section and Community Care Hub page of the Coverage Toolkit for more information.

- 1115 waiver: States can seek an 1115 waiver that would allow for 12-month continuous eligibility for its adult Medicaid population regardless of changes in income or household size. See the 1115 Waivers page of the Coverage Toolkit for more information on 12-month continuous eligibility.

- Require Medicaid MCOs to offer Affordable Care Act Marketplace plans: States may encourage or require health plan participation in both Medicaid and the Marketplace to ease transitions due to churn and reduce the risk of coverage gaps. These policies could enable participants in the National DPP lifestyle change program or other evidence-based programs to more seamlessly change insurance plans while staying enrolled in their programs. For more information, visit Health Management Associates’ How States Are Shaping Medicaid Managed Care and Marketplace Participation.

- Implement automated renewals: Allow the use of information from other available data sources to verify eligibility, such as quarterly wage data and information from other public programs, such as the Supplemental Nutrition Assistance Program (SNAP). Verifying eligibility in this manner may reduce disenrollments based on missing information or changes in beneficiary contact information. For more information, see MACPAC’s Issue Brief: An Updated Look at Rates of Churn and Continuous Coverage in Medicaid and CHIP.

- Longer-term commitments to health plan membership: Consider offering Medicaid eligible individuals the opportunity to commit to staying in a health plan for at least a year.

- MCO commitments: Consider engaging Medicaid MCOs to jointly agree to allow new members who are already enrolled in the lifestyle change program or other evidence-based programs to continue without interruption.

- Self-pay or other funding mechanism: In some cases, participants interested in continuing programs may need to switch to self-pay, or the CDC-recognized organization may need to waive payment or seek an alternate funding mechanism (such as grant funding). State agencies, health plans, organizations, or UHAs/CCHs could consider designating continuation funds to support participants undergoing a change in coverage status.

Centers for Medicare & Medicaid Services Medicaid ‘Free Care’ Guidance

When the National DPP lifestyle change program becomes a covered service under state Medicaid there may be questions whether a provider can bill Medicaid for providing the service to eligible Medicaid beneficiaries while offering the program for free to other participants. CMS released guidance in 2014 that states, “Under this guidance, Medicaid reimbursement is available for covered services under the approved state plan that are provided to Medicaid beneficiaries, regardless of whether there is any charge for the service to the beneficiary or the community at large.” So, from a federal standpoint, there is not an issue with billing Medicaid for the covered service while offering the program for free to others.

Rate Setting

In the course of implementing the National DPP lifestyle change program for Medicaid beneficiaries, states will need to fund the intervention and/or negotiate increases in rates paid to participating MCOs. Rates may need to account for the work MCOs will undertake in establishing and maintaining contracts with CDC-recognized organizations, cost reporting, as well as the uncertainty relative to programs costs within Medicaid.

States and their MCO partners may determine to make the rate for the National DPP lifestyle change program a per-member-per-month (PMPM) add-on to the total capitated rate for adults over 18. This may aid in creating visibility around the rate as it is refined over time. Rates may be negotiated in the context of discussions between the state’s actuarial subgroup, the health plan’s actuaries, and financial staff from the relevant CDC-recognized organizations. As noted above, some CDC-recognized organizations may be willing to accept payment contingent on participant outcomes such as weight loss.

An alternative would be to carve out the program from the capitation structure, and to pay for it on a pay-for-performance or fee-for-service model based on session attendance or other milestones.

In addition to the cost and reimbursement information presented above, see Statistics on enrollment and retention on the Retention page.

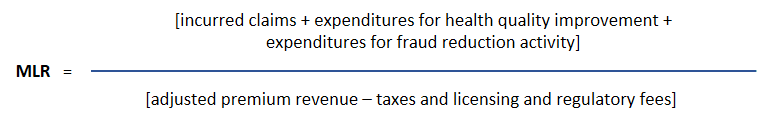

Medical Loss Ratio

The National Diabetes Prevention Program (DPP) lifestyle change program can be counted in the numerator of the Medical Loss Ratio.

The Medical Loss Ratio is the percentage of an insurer’s premium dollars that is spent on medical care and quality improvement activities. For example, if an insurer spends 85 cents of every premium dollar on medical care and quality improvement activities, its MLR is 85%. The National DPP lifestyle change program can be counted as either the medical care or a quality improvement activity component of that calculation. Note: some exclusions apply as listed in additional detail below.

Per the Affordable Care Act, insurers must spend at least 85% of their Medicaid revenue on medical care and other activities that improve quality. The remaining 15% can be spent on administrative costs and profits.

Additional Detail About the Medical Loss Ratio

The final rule on Medicaid managed care regulations that CMS released in May 2016 addresses the calculation of the MLR. If the National DPP lifestyle change program is a Medicaid covered benefit, program expenditures can be included as incurred claims. If the National DPP lifestyle change program is not a covered benefit, it can still be counted as a quality improvement activity for purposes of the MLR calculation if administered in a way consistent with Title 45 of the Code of Federal Regulations (CFR). Title 45 addresses the rules and regulations regarding public welfare programs. The program must meet the requirements outlined in 45 CFR 158.150(b) and not be excluded under 45 CFR 158.150(c) (see 45 CFR 158.150(b)(1), (b)(2), and (c)[1]).

Specifically, 45 CFR 158.150(b)(2)(iv)(A) includes the following language: “(2) Wellness/lifestyle coaching programs designed to achieve specific and measurable improvements; (3) Coaching programs designed to educate individuals on clinically effective methods for dealing with a specific chronic disease or condition; … (7) Coaching or education programs and health promotion activities designed to change member behavior and conditions (for example, smoking or obesity).”

45 CFR 158.150(c) lists exclusions to quality improvement activities and includes the following language: “(3) Those which otherwise meet the definitions for quality improvement activities but which were paid for with grant money or other funding separate from premium revenue; (4) Those activities that can be billed or allocated by a provider for care delivery and which are, therefore, reimbursed as clinical services [Note: these would count as incurred claims and be accounted for in the numerator of the MLR]; … (12) Costs associated with calculating and administering individual enrollee or employee incentives.”