Umbrella Hub Arrangements → Business Model for Umbrella Hub Arrangements

Business Model for Umbrella Hub Arrangements

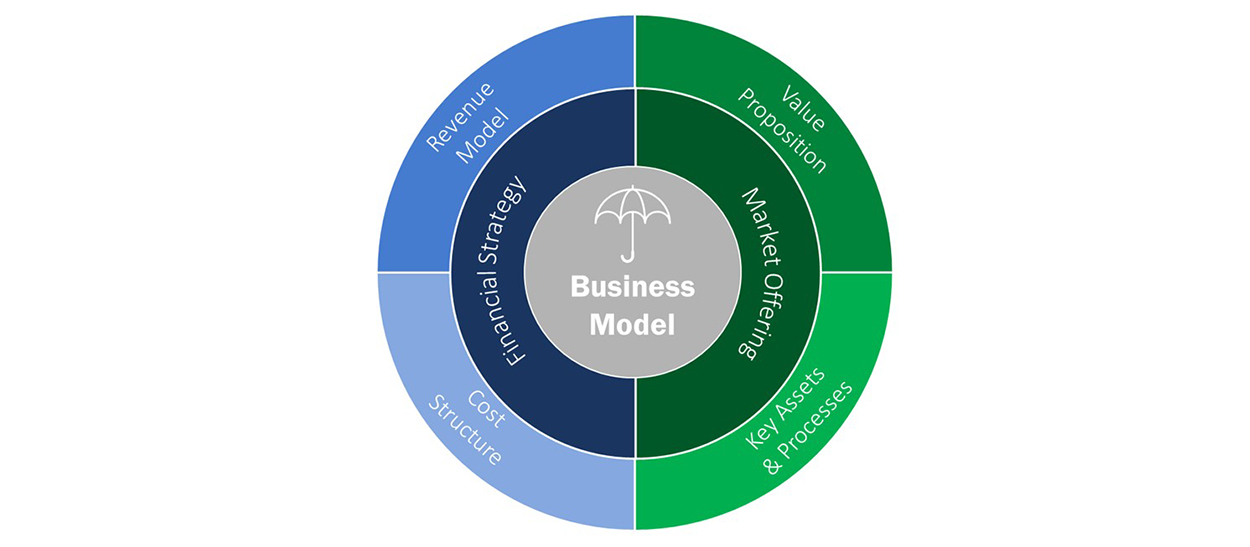

A business model refers to the design for the successful operation of a business. It includes how to appeal to customers, how to identify revenue sources, and how to understand costs. Considering the business model for the umbrella hub arrangement (UHA) can help the umbrella hub organization (UHO) create an arrangement that: (a) meets the needs of the partners it wants to serve (subsidiary organizations) and the partners to which it wants to appeal (health care payers), (b) is financially possible and sustainable for both the UHO and the subsidiary organizations, and (c) prioritizes and improves health equity among the population it serves.

The figure below shows a sample UHA business model and is intended to provide a framework for UHOs. UHOs are advised to adapt the business model to fit the needs and goals of their organization and the UHA or to develop a business model more appropriate to their needs. Since the Demonstration UHOs are in the process of operationalizing their UHAs, the UHA business model has yet to be fully tested.

Hover over the green plus signs ![]() on the image below to learn more.

on the image below to learn more.

Learnings from the Umbrella Hub Demonstration that correlate with this Coverage Toolkit page (learnings related to the UHA business model and contracting) are in the document titled, Learnings from the Umbrella Hub Demonstration – Business Model and Contracts. For all of the learnings from the Umbrella Hub Demonstration refer to the full document, Learnings from the Umbrella Hub Demonstration.

The following page is divided into four sections. First the components of the UHA business model will be introduced and defined. Following the definitions, context will be provided around the two sub-components of the UHA business model, the Market Offering and the Financial Strategy. Details will be included on how to incorporate health equity strategies into each sub-component. Finally, considerations for initiating and executing contractual agreements to connect components of the UHA will be provided.

- Business Model Definitions

- Market Offering

- Financial Strategy

- Contractual Agreements for Umbrella Hub Arrangements

Business Model Definitions

The sample UHA business model is divided into the market offering (which includes the key assets and processes and the value proposition of the UHA) and the financial strategy (which includes the cost structure and the revenue model of the UHA). Definitions for each portion of the business model are provided below.

- Financial Strategy: The UHA’s revenue and costs

- Costs: The expenses for standing up and operationalizing the UHA

- Revenue Sources: How the UHA will receive money to operate and become sustainable

- Market Offering: What the UHA is providing to the partners it aims to serve (subsidiary organizations) and the partners to which it wants to appeal (health care payers)

- Value Proposition: What makes the UHA attractive to the UHO, potential subsidiary organizations, and health care payers

- Key Assets and Processes: The processes and assets the UHO will deliver on its value proposition to subsidiary organizations and health care payers

Market Offering

Value Proposition and Key Assets and Processes

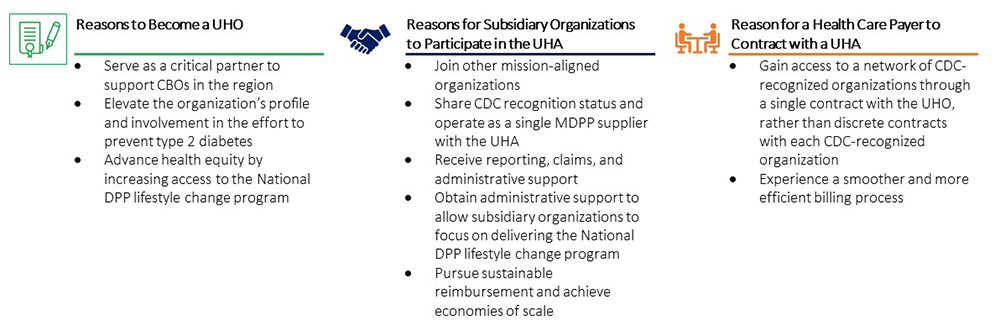

The Umbrella Hub Arrangement Overview page provides details on the value proposition and the key assets and processes offered by a UHA and includes how the UHA can influence and improve health equity. A summary of the value proposition of a UHA for the UHO, subsidiary organizations, and health care payers is summarized in the graphic below.

Recruiting community-based organizations (CBOs), payers, and other partners to participate in the UHA relies on the UHOs ability to communicate the value proposition and the key assets and processes of their organization to these other entities. By illustrating the value proposition during partner recruitment, the UHO demonstrates it has effective strategies for meeting its partners’ needs. Engaging in a conversation early and often with potential partners also helps the UHO refine its value proposition by increasing its understanding of what appeals to various partners. The UHA Value Proposition Workshop was created to assist organizations in developing their value proposition by outlining the list of services and supports partners can expect from the UHA. The resource may be useful to the project team responsible for building the business strategy for the UHO as well as for staff responsible for marketing, communications, and partner engagement. For additional assistance in communicating the UHA model and the UHA value proposition to potential partners, reference the UHA Modifiable Slide Deck. You can learn more about the UHA Modifiable Slide Deck and how to use it, by reading through the accompanying Introduction to the Modifiable Slide Deck.

Considerations for Incorporating Health Equity into the UHA Market Offering

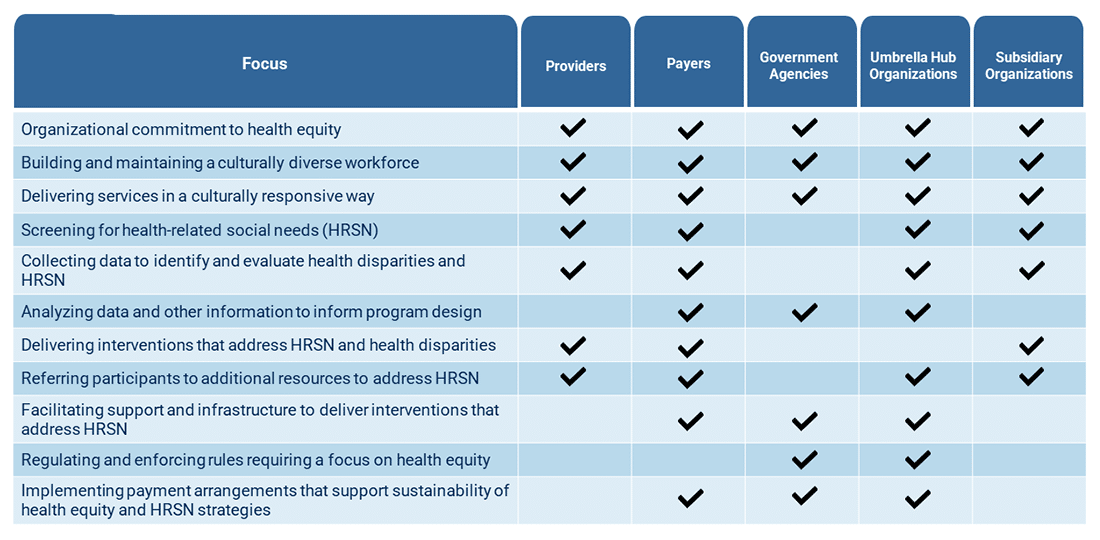

Each partner involved in the UHA, including UHOs, subsidiary organizations, conveners (such as the state health department), payers, and billing/technology vendors, provide unique strengths which can be leveraged to improve health equity. The table below illustrates how each UHA partner can contribute to health equity goals.

Additional examples, including details provided by existing UHAs, of how each UHA partner can contribute to the overall goal of improving health equity are provided below.

UHOs

UHOs may take the following actions to improve health equity:

- Negotiate reimbursement rates with payers which promote and sustain efforts to both deliver the National DPP lifestyle change program and incorporate HRSN screening and referral into enrollment processes.

- Ensure accuracy of participant data, including demographic data which can be used to inform health equity strategies.

- Consolidate and evaluate enrollment data across the UHA to determine effective referral pathways and retention strategies.

- Verify UHA legal documents contain components that support health equity.

- Engage CBOs that provide services to address HRSN.

- Support subsidiary organizations to adapt and tailor the National DPP lifestyle change program curriculum for priority populations (e.g., language translations and/or curriculum updates for older adults).

- The Association of Asian Pacific Community Health Organizations (AAPCHO) Pacific Islander Center of Primary Care Excellence assembled community collaborators and trusted subject matter experts to adapt the National DPP PreventT2 curriculum to incorporate health beliefs and cultural approaches specific to the Native Hawaiian and Pacific Islander communities they serve. They also worked with Lifestyle Coaches to translate curricula into five Pacific languages spoken by populations served in the Continental U.S., Hawaii, and the U.S. Affiliated Pacific Islands. All available translations of the National DPP Lifestyle change program can be accessed on the Curriculum page of the Coverage Toolkit.

- Provide training and support to subsidiary organizations to understand and incorporate processes centered on working with priority populations and improving health equity.

- The Hawai’i Primary Care Association (HPCA) UHO holds regular meetings with their subsidiary organizations which include presentations and trainings on topics relevant to their participant population. These presentations are provided by subject matter experts at HPCA or partner organizations like the University of Hawai’i School of Medicine and include topics like screening for social determinants of health (SDOH) and caring for older adults. As part of their organizational operations, the HPCA UHO ensures that subsidiary organizations regularly conduct SDOH screening of National DPP lifestyle change program participants to connect participants to appropriate resources. These meetings provide opportunities for subsidiary organizations to present challenges faced by their populations of focus and ideas for recruiting traditionally hard to reach populations.

- Confirm UHA evaluation metrics contain measures intended to monitor and ensure progress in UHA efforts to address HRSN.

Subsidiary Organizations

Subsidiary organizations may take the following actions to improve health equity:

- Hire and train staff who are representative of and from the community they are serving, including individuals able to speak commonly spoken languages and understand cultural practices with a high-level of competency.

- Screen participants for HRSN and provide resources to meet participant needs.

- Within their internal platform, Trellis/Juniper has incorporated the Accountable Health Communities SDOH Screening Tool developed by the Centers for Medicare & Medicaid Services (CMS) Center for Medicare/Medicaid Innovation. Through their platform, subsidiary organizations can either screen participants for HRSN or refer them to a Trellis/Juniper community health worker who will complete the screening on their behalf. Once completed, participants can be connected with resources available to address HRSN.

- Provide perspectives unique to populations of focus.

- Understanding that food security can be negatively impacted when households have limited access to working appliances, the National Kidney Foundation of Michigan (NKFM) UHO is providing Instant Pots with culturally appropriate recipes as program supports to National DPP lifestyle change program participants who meet certain program milestones. Tailored to unique participant needs, NKFM subsidiaries also offer gift cards to local business which supply groceries, gas, clothing, or household goods.

State Health Departments and Conveners

State health departments and conveners may take the following actions to improve health equity:

- Communicate regional health equity goals to implement with partners.

- Connect UHAs to funding streams and/or concurrent initiatives or interventions for addressing HRSN.

- Facilitate data sharing to help the UHO understand population needs.

It is also important for UHOs to understand the value of integrating health equity strategies into the business model when marketing the UHA to potential partners. Benefits of prioritizing health equity may include increased participant retention, improved National DPP lifestyle change program outcomes, reduced overall costs due to lower prevalence of type 2 diabetes (particularly among populations of focus), and improved cross-sector collaboration. Prioritizing health equity also improves the level of trust community members have in the UHA and reduces barriers to participation.

Finally, when incorporating health equity strategies into the UHA Business Model, UHOs should aim to understand the knowledge, skills, and abilities needed to address HRSN among participants. Understanding the capacity of the UHA to address HRSN can help organizations build out a value proposition and develop a financial strategy that allows for a sustainable process to accomplish these goals. It is recommended that UHOs perform capacity assessments which include the UHO’s ability to:

- Coordinate with subsidiary organizations to develop a protocol for addressing HRSN.

- Provide technical assistance to subsidiary organizations on providing resources to address HRSN.

- Assist subsidiary organizations in providing program supports for National DPP lifestyle change program participants. For additional information on program supports, please see the Addressing HRSN Through the National DPP Lifestyle Change Program page of the Coverage Toolkit.

- Collect data on participant HRSN at state, community, and population of focus levels.

- Incorporate screening and/or multi-directional referral tools into subsidiary organization and UHO processes.

- Evaluate the impact of HSRN actions on National DPP lifestyle change program participant attendance and retention.

- Verify how billing and claims system can accommodate the associated efforts.

Financial Strategy

Many factors can influence a UHA’s financial strategy, including the UHO structure, the composition of subsidiary organizations, and the payer landscape. The financial strategy for the UHA includes considerations for both the cost structure and the revenue model used.

Cost Structure

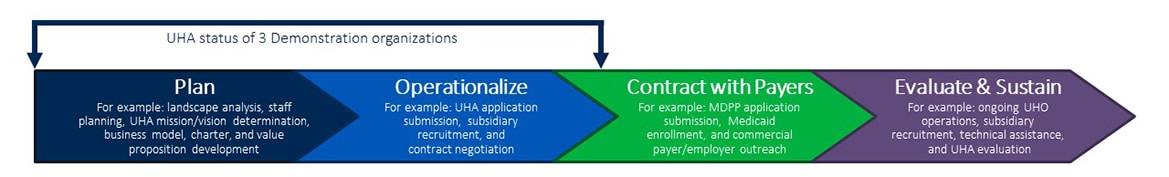

UHA costs include (but are not limited to): (1) costs associated with operationalizing a UHA and (2) costs associated with maintaining the UHA. To help understand costs needed to operationalize a UHA, a Cost Study was completed at the beginning of the Umbrella Hub Demonstration. The three Demonstration UHOs tracked time for each staff member and costs for project activities from August 2020 through July 2021. Some of these tasks included initial UHA planning, recruiting, and contracting with subsidiaries, executing the Medicare Diabetes Prevention Program (MDPP) supplier application, and engaging with a billing partner.

The 12 months of data captured in the Umbrella Hub Demonstration Cost Study only represent part of the time and activities needed to establish a UHA. The three Demonstration organizations began activities at staggered intervals. HPC and HPCA began in March 2020, followed by Marshall University in August 2020. As a result, the Demonstration organizations’ statuses and milestones achieved during the cost study period vary. An estimate of the aggregate activities of the three Demonstration UHOs during this period is provided in the graphic below.

Each UHA is unique. The tasks, activities undertaken, and staffing described in the Umbrella Hub Demonstration Cost Study reflect start-up processes for each Demonstration UHO. The Umbrella Hub Demonstration Cost Study may or may not be representative of what other UHAs are able to achieve in a one-year period. More learnings related to costs of operationalizing a UHA will be added as they become available. Additional costs for UHAs to consider are indicated below. However, there may be other costs UHAs incur that are not captured.

Potential Start-up Costs:

- Staff time to identify and recruit subsidiary organizations

- Staff time to complete the CDC National DPP UHA Application for CDC-Recognized Organizations

- Staff time to identify and contract with a billing vendor (or confirm in-house billing capabilities will meet the needs of the UHA)

- Staff time to access payer reimbursement. For example:

- Complete the MDPP enrollment application;

- Enroll in Medicaid, if coverage is available; and/or

- Contract with private health care payers

- Legal counsel associated with developing and executing contracts (see the Contracts section of this page for more information)

Potential Ongoing Costs:

- Staff time to engage with a billing vendor, support claims submission, and maintain Diabetes Prevention Recognition Program (DPRP) recognition

- Staff time to maintain accuracy and upkeep of relevant databases needed by contracted payers

- Staff time for ongoing engagement with subsidiary organizations, including support for technical assistance

- Costs associated with increasing the sustainability of the UHA (for more information see the Sustaining Umbrella Hub Arrangements page)

Revenue Model

Revenue from Payers and Other Funders

Unless the UHO has enough capital to set up the UHA, the UHO may need to secure start-up funds from external organizations. Potential funders, public or private, can help launch a UHA by supplementing costs before payer reimbursement reaches sustainable levels.

UHAs may use a multi-year approach to achieve sustainability. For example, the UHA could use grant funding or other funding sources to operationalize the UHA and a combination of grant funding and payer reimbursement in subsequent years, eventually reaching the goal of the UHA operating primarily on payer reimbursement from a diverse payer mix.

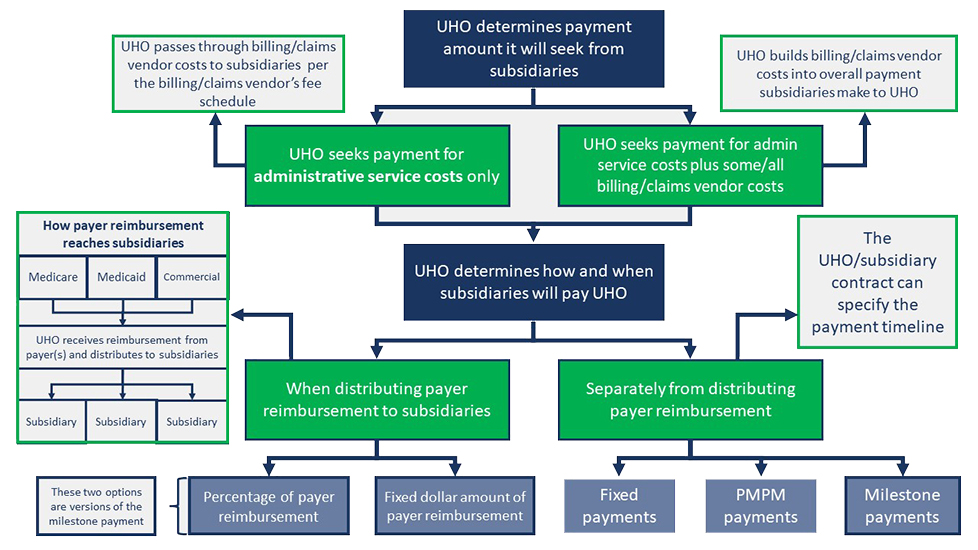

Payment from Subsidiary Organizations

Accepting payments from subsidiary organizations may be critical to helping the UHO offset the costs of operationalizing and sustaining a UHA. UHOs will likely charge the subsidiary organizations a fee for the administrative services provided. UHOs are encouraged to discuss the following both internally and with subsidiary organizations.

- UHO payment collected from subsidiary organizations: UHAs have flexibility in how the fee is structured and how much subsidiary organizations will contribute to offset costs of the UHO’s administrative functions.

- Costs associated with the billing vendor: The UHO can determine whether to build these costs into the payment subsidiaries make to the UHO, or to pass the costs through to subsidiaries per the vendor’s fee schedule.

- Timing of payments from subsidiary organizations: The UHO has flexibility in setting up the payment process. The UHO could carve out its required payment before distributing the health care payer claims reimbursements to subsidiary organizations or receive a payment from the subsidiaries after passing on full reimbursements to subsidiary organizations.

UHOs are encouraged to be in transparent dialogue with subsidiary organizations when making decisions about payments.

Umbrella Hub Arrangement Financial Structures

If the UHO decides to carve out its required payments from subsidiary organizations before distributing claims payments, the UHO could decide to take a percentage of the claims payments or apply a fixed dollar amount to each claim payment.

If the UHO decides to seek payments from subsidiary organizations separately from claims payment, the UHO could consider three possible ways to structure the financial payments from subsidiary organizations, depicted in the bullets below. These approaches are not inclusive of all options.

- Fixed Payment: The UHO is paid a predetermined, fixed amount that is divided evenly among the subsidiary organizations.

- Per Member Per Month (PMPM) Payment: The UHO is paid a per member per month (PMPM) amount from the subsidiary organizations. The amount of money the UHO receives depends on the total number of participants spread across the subsidiary organizations.

- Milestone-Based Payment: The UHO is paid a percentage of the subsidiary organizations’ reimbursements if certain milestones are reached.

During the Umbrella Hub Demonstration, NACDD and Leavitt Partners summarized the considerations for subsidiary payments to the UHOs as depicted in the figure below.

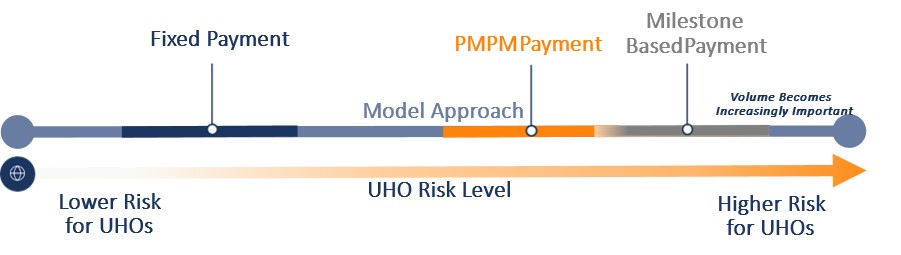

Risk Considerations

The different ways the UHO can collect payment from subsidiary organizations involve different levels of financial risk for the UHO and the subsidiary organizations (see figure below). For example, if the UHO is using a fixed payment approach—meaning that the subsidiary organization will pay the UHO a predetermined and set amount regardless of the subsidiary program’s enrollment or reimbursement from health care payers—then the UHO is incurring lower financial risk because the UHO will be paid regardless. Conversely, in a milestone-based payment arrangement where the UHO receives payment from subsidiary organizations based on the subsidiary organization’s claims reimbursements from health care payers, the UHO is incurring more financial risk—and indeed sharing in the risk with the subsidiary organizations. Although it introduces more risk for the UHO, a shared risk model, such as milestone-based payment, could benefit the entire UHA by aligning the UHO’s and the subsidiary organizations’ incentives to access health care payer reimbursement.

- Determine the appropriate payment model for your organization: Two UHOs in the Demonstration plan to retain a percentage of health care payer claims reimbursement to cover administrative costs before distributing reimbursement to the subsidiary organizations. All agreements are decided on and included in contracts or charters between the subsidiary organizations and UHOs.

- Model different payment scenarios: UHOs are encouraged to sketch out different scenarios for how much they will charge subsidiary organizations that participate in the UHA and how those charges will be applied. In these efforts, Demonstration UHOs have considered variables such as: available reimbursement from health care payers (e.g., MDPP fee schedule), participant volume in subsidiary organizations’ programs, participant retention and weight loss, billing vendor fees (annual, start-up, and other), the UHO’s costs of operating the UHA, and amounts subsidiary organizations pay to the UHO for administrative fees.

- Establish an accounting system that allows the UHO to distribute reimbursement to subsidiary organizations: The UHO is responsible for reconciling and distributing payments to subsidiaries. Demonstration UHOs established new accounting processes that allowed them to accept payment from Medicare and other payers and distribute those payment to subsidiary organizations. For example, Demonstration UHOs obtained distinct banking deposit accounts and UHO-specific identifiers to assist in keeping reimbursements separate and distinct from other lines of business. For more information on creating a business entity for the UHO, please see the UHO MDPP Supplier Enrollment Guide.

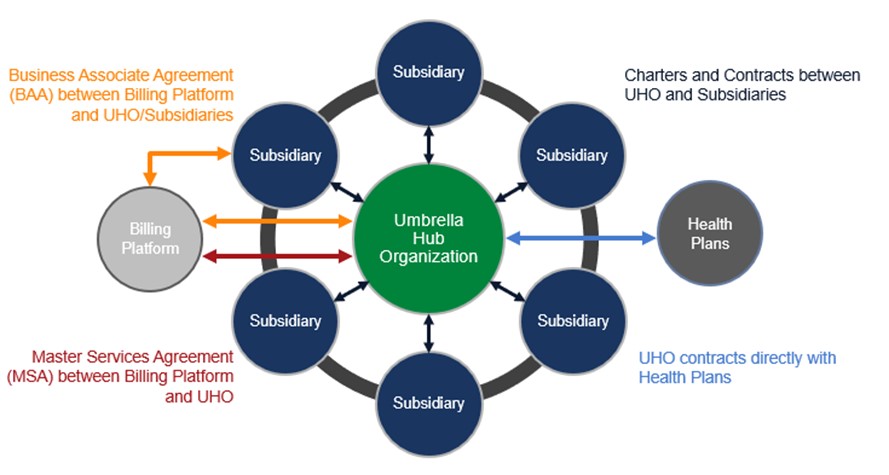

Contractual Agreements for Umbrella Hub Arrangements

When a UHA is formed, the subsidiary organizations and the UHO become a new business entity. The UHA is a contractual entity that is bound together by a series of agreements. The UHO is providing services for subsidiary organizations, and this requires the subsidiary organizations to enter a contract with the UHO. Likewise, if the UHA is using a billing vendor, the UHO and each subsidiary organization will have a contract with the billing vendor. Finally, a charter between the UHO and each subsidiary can help align all participants in the UHA to a shared vision and purpose.

Contracts

Contracts

Contracts detail the expectations, roles, and responsibilities for each entity in the UHA. The figure below illustrates the contracting arrangement used in the Umbrella Hub Demonstration, though each UHA may be unique in its contracting arrangement.

For an additional example of how the different contracts and agreements can join a UHA together, please see the Diagram of Contracting in the Umbrella Hub Demonstration.

The following sections describe example content in the various UHA contracts.

Contracts Between UHOs and Billing Vendors:

- Expectations for both parties on claims submission and other types of data submission (as applicable), including timelines and responsibility for data accuracy and completeness

- Expectations for the payment amount and timing of payment the UHO will make to the billing vendor

- Expectations for how the subsidiary organizations’ data can be used

Contracts Between UHO and Subsidiary Organizations:

- Expectations for subsidiary organizations on data collection and submission, including timelines and responsibility for data accuracy and completeness

- Expectations for subsidiary organization payment to the UHO for administrative services and/or vendor fees

- Expectations on subsidiary performance related to CDC- recognition parameters

Business Associate Agreement Between Subsidiary Organizations and Billing Vendor:

- Expectations for use of private health information and compliance to Health Insurance Portability and Accountability Act (HIPAA) standards

- Expectations for both parties on data collection and submission, including timelines and responsibility for data accuracy and completeness

- Expectations for payment amount and timing of payment the UHO and/or the subsidiary organizations will make to the vendor

For examples of business associate agreements (BAAs) between all UHA participants, please see the two sample BAAs below.

- Provide enough time and resources for contracting efforts: Demonstration UHOs found that the contracting process took more time than originally anticipated. In general, it took around a year to operationalize a UHA including contracting between entities.

- Hire a lawyer or use in-house legal counsel to assist in contract development and review: Demonstration UHOs noted legal teams were a valuable resource for resolving language concerns and other concerns in their contracts.

- Develop HIPAA-compliant processes: At least one Demonstration UHO provided HIPAA training to their subsidiary organizations and found secure ways to store and share data.

Charters

Charters

Although a charter is not required, having a shared agreement on the structure and operating principles of the UHA can establish a shared vision for the UHA. Additionally, the charter can state the UHA’s goals and outline the roles and responsibilities of the UHO, the subsidiary organizations, and the billing vendor.

For examples of charters between a UHO and subsidiaries, please see the two sample charters below.

- Collaborate with subsidiary organizations to develop a charter: Demonstration UHOs worked closely with their subsidiary organizations to develop a charter. Collaborating on the charter builds trust between the UHO and subsidiary organizations and helps establish agreement on the mission of the UHA.

Resources for Umbrella Hub Arrangements – Business Model